3 useful examples that compare the costs of a bespoke SIPP

Back in 2021, you read about the benefit of IPM’s fixed-fee structure for SIPPs and looked at how we compared to some of our competitors in the SIPP market.

One of the regular things we hear from advisers when discussing SIPP provider fee structures is that these can often be complex. This can make it difficult to ascertain exactly how much a client is likely to pay for their SIPP year-on-year.

Not much has changed in over two years since we first produced this article, although the introduction of Consumer Duty and Fair Value Assessments have gone some way to help this. You can find all IPM’s Consumer Duty information on our website.

You will have recently received correspondence from IPM confirming our annual administration fee is to increase from 1 January 2024 to £580 + VAT – the first such increase in 21 years!

Simple, transparent fees

Despite the annual administration fee increase, we will not charge for:

- Accepting contributions

- Transfers into a SIPP*

- Making standard, UK-based investments

- Holding different standard investments within the SIPP

- Moving money to or from the trustee bank account, or for responding to emails or telephone calls.

*Additional fees can apply for some in-specie transfers

For those clients in drawdown, our annual drawdown fee of £150 + VAT and benefit crystallisation event fee of £150 + VAT remain unchanged.

Why we believe scenario-based charging helps you to explain SIPP fees

In our 2021 article, we talked about the importance of looking at scenario-based charging when trying to compare the costs of SIPP providers.

In our experience, this is an effective way of comparing providers as you can apply the charging structures of the providers of your choice to a specific scenario, thus giving you a side-by-side comparison.

You can then extrapolate these fees over the next 10 years to get an idea of the total cost to the client during this period.

Below, you’ll find some examples of how other providers’ charges compare to IPM’s revised charging structure from 2024.

Please note that the indicative costs for the other SIPP providers below are based on a random selection of full, bespoke SIPPs and do not accurately reflect any specific SIPP provider. The tables are for illustrative purposes only and should not be used for actual comparisons.

We have not considered online SIPPs or simple SIPPs for this comparison, due to the fact that there are so many variables to each of these types of offering. For example, some may accept an asset class under a simple SIPP, but another may not.

The idea of sharing these scenarios is to show you the benefits of a simple fee structure and how scenario-based cost comparisons are an accurate and simple way of understanding a provider’s charges – especially compared with some of the complexities of our competitors.

These examples also show you why the way we charge is more straightforward for you and your clients and makes it easier for you to compare the relative costs of our SIPPs versus other providers. Note that VAT has not been applied to these charges.

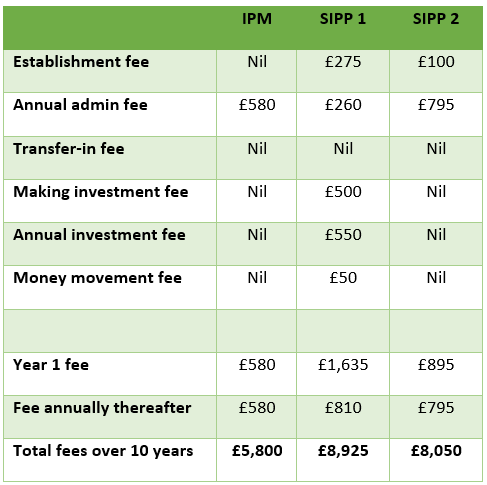

Scenario 1

In this simple and common scenario, your client wishes to:

- Set up a SIPP

- Conduct two “transfers in”

- Invest using a DFM

- Benefit from a platform

- Open two deposit accounts.

When looking at full, bespoke SIPP providers, even a scenario that we see as common can produce a varying degree of fees when it comes to SIPP providers.

Often, clients will incur fees for holding more than one investment, or an investment that is deemed off panel. These can be charged either initially and/or on an ongoing basis.

Scenario 2

In this scenario, your client wishes to:

- Set up a SIPP

- Conduct one “transfer in”

- Benefit from platform and trustee investment bond investments

- Take the maximum PCLS and then pay monthly income.

Most providers will levy a fee for paying a PCLS and then an annual drawdown fee thereafter. What is more difficult to demonstrate, however, are the different charges that relate to how income is drawn.

Some providers charge more for higher frequency withdrawals while some make an additional charge for ad hoc income payments. Note also the differing charges for investments.

Again, our structure means your client simply pays the same fixed fee every year, plus a one-off BCE fee. We do not charge to vary the income amounts, frequency, or if the client wants a one-off payment.

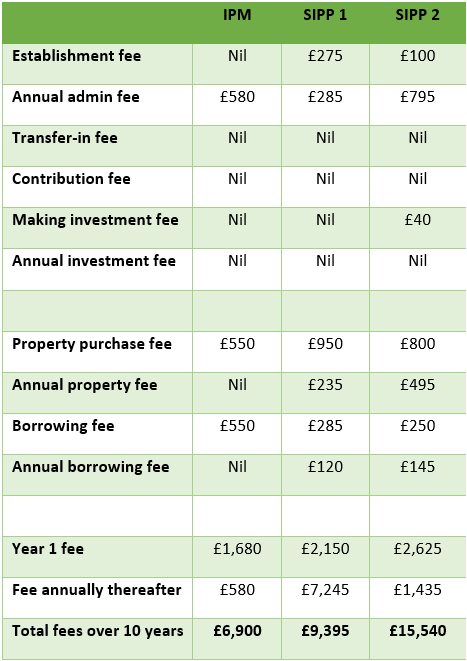

Scenario 3

In this third scenario, your client wishes to:

- Set up a SIPP

- Conduct one “transfer in”

- Make one contribution

- Purchase commercial property with borrowing

- Benefit from a platform account in the SIPP.

When we start looking at costs for commercial property purchase within SIPPs, this is where the cost benefits of the IPM SIPP really start to show.

IPM are well-priced for commercial property within a SIPP, mainly down to the fact that we do not charge an annual property fee or annual borrowing fee on top of our annual administration fee. Most other providers will make this charge, and this is where the fees over a 10-year period can start to accumulate.

That said, cost comparison for SIPP providers on property purchases is tricky. Many providers will charge a minimum fee or levy a time-costs charge.

The varying nature of holding a property within a SIPP will also make a comparison difficult. For example, IPM will charge a fee of £200 to put a new lease in place – but how regularly this fee will apply will depend on the length of the lease within the SIPP.

Read more about the IPM approach to commercial property purchase.

What these comparisons mean for you and your clients

The idea of illustrating these comparative methods of charging is not to compare IPM’s charges with other providers.

We accept that these tables look favourable to IPM! While this was not our aim when we set out on this exercise, it does reinforce our belief in the benefit of charging on a predominately fixed-fee basis, which is the way we have always operated.

This way, clients always know in advance what their fee to IPM is going to be, year in, year out. It also makes it easier for advisers and planners to explain to their client how much an IPM SIPP will cost.

See how our SIPP offers complete investment flexibility for a fixed fee.

Get in touch

If you’d like to explore how our fixed-fee SIPP can offer value to clients, please get in touch. Email info@ipm-pensions.co.uk or call 01438 747151.