4 important IPM services you can now easily access online

You may have recently seen us ask for your feedback in our 2024 adviser survey.

We’re grateful to those of you who took the time to complete this. It has provided us with invaluable insight into the things you like (and don’t like) about IPM and has given us plenty of food for thought as to where we can improve.

Click here to read all about the highlights from the survey responses.

In recent years we have invested heavily in the development of what we offer to both advisers and clients online. While we know our online offering is not at the level of some other, larger providers in the market, we have made significant progress and this is an area that we are committed to continuing to improve.

Over recent times we have communicated these enhancements through our regular monthly newsletters as well as in our discussions with advisers.

So, some of the most eye-catching results of our survey relate to advisers not being aware of the enhancements we have made to our online offering.

For example, almost half of respondents were not aware that our forms can now be generated online for completion by your clients electronically, or that you can now produce your own illustrations.

Some comments we received included:

- “Didn’t know you had made any online enhancements” (or a variation of a theme x11!)

- “You need to move to DocuSign”

- “Reduce your need for wet signatures”

- “Is secure messaging available?”

- “You should accept electronic signatures like your competitors”.

With that in mind, we thought it would be useful to highlight four key changes we have made over the last couple of years, so you make the most of the IPM online offering.

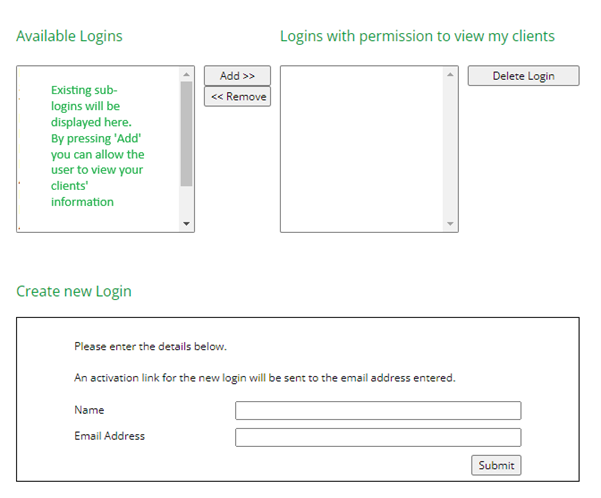

1. Automated registration and sub-logins

Registering for online access for FCA-regulated advisers is now an automated process that you can do through our website.

Providing that the information entered during the registration matches what we hold in our back office, your access and login details should be generated in a matter of minutes. You should receive confirmation of this in your inbox.

If there is a discrepancy between the information submitted and our records, your request will be put on hold while a member of the team manually reviews this.

IPM’s online access gives access to the clients we have on our systems where the user is the named adviser. This means that the automated registration process is only for FCA-regulated advisers.

However, we know that it is important that support staff within an adviser firm also have access to client information. Advisers also expressed to us during our review of our old online access that it is also important for them to be able to control who has access to this information.

With this in mind, we created a sub-login option. This allows advisers with online access to invite colleagues to create their logins so they can view client information.

Once you have created a sub-login, other advisers within a firm can simply select that user to gain access to their clients too, rather than having to create new sub-logins for each adviser’s clients.

In the event of that member of staff leaving, or no longer with a specific adviser, the adviser is then able to amend the permissions of the sub-login to ensure client information remains secure.

2. Illustrations

It is now possible for users to produce their own illustrations for clients online. Simply click the “Illustrations” button along the options at the top of the screen when you log in.

You will then be taken to a page on our site which explains the various illustrations that are available. You can view notes to assist you in producing your illustrations – simply press the link in the text to access these.

![]()

IPM licences our illustration system from CTC Software. When you click the “Generate Illustrations” button, you will be taken to IPM’s area of their site, where you can start entering information to produce your illustration.

After clicking “Workflows”, you will then be presented with the various illustration types available.

The most common form of illustration we produce is “Retirement Accumulation”, which allows you to project the value of a SIPP to a point in the future with several factors considered.

“Income Withdrawal” illustrations allow you to enter the same information, although on this occasion you are also able to include amounts you would like the system to take into account when it comes to drawing benefits from the SIPP.

3. Online forms

One of the more regular pieces of feedback we receive is that advisers wish we could do away with the need for original forms.

So, you may be surprised to learn that IPM has been able to offer most of our forms through DocuSign for more than three years now! Where our forms are completed through DocuSign, IPM does not require original paperwork to be sent to us.

(Note that the final piece of the jigsaw is to facilitate the establishment of new SIPPs fully through digital signatures. We’re in the process of finalising this and hope to have this available before the end of 2024).

There are two ways you can arrange to have one of IPM’s forms completed electronically:

- Contact us, explain what it is you are looking to do, and we will set up a DocuSign envelope with the forms that require completion. These will be sent to you as the adviser initially, before going to the client. Once completed, the form is returned to IPM electronically and our requirements are complete.

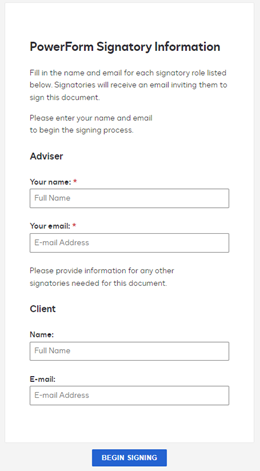

- The adviser can generate the DocuSign envelope through the IPM online access.

When you click the “Online Forms” button at the top of the screen, you will be taken to a screen that shows all the forms that are available to be completed online.

Once you’ve pressed the form you wish, this will take you DocuSign’s website with the envelope created and the form already attached. You will then need to enter your details, as the adviser, and those of your client who needs to complete the form.

Once this information is complete, hit the “Begin Signing” button.

Note – some of our forms require the signature of the FCA regulated adviser, so their details should be entered where it asks for “Adviser”. It is possible, however, to reallocate who completes the form once the envelope has been sent.

You will then be taken to the screen of the form you have selected, where you are then able to complete the required fields on the client’s behalf.

Once completed, press the “Finish” button at the top. This will then be sent to the client’s email address as entered in the previous step. You do have the option to save and revisit later, should you wish.

Once the client has done their part, a copy of the completed form will be sent to you, the client, and IPM.

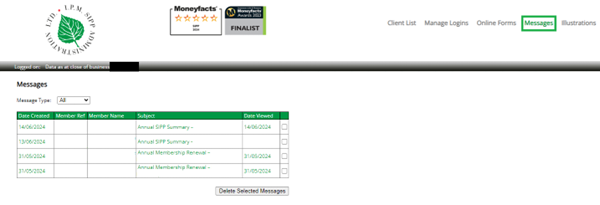

4. Secure messages

In line with both adviser and client feedback, together with our aims of reducing the amount of paper we use, we will increasingly be utilising the secure messaging function of our site.

Initially, we will send required documentation such as annual valuations, payslips, P60s, and annual fee requests on behalf of clients using this method. We aim to expand this over the coming months.

When we have issued a secure message, we will send an email to the registered email address we have on record, notifying you of this. You are then able to log in to your IPM online access to view this information, download it, or save the details.

Get in touch

We hope this has provided a useful overview of our online services.

Outside of our surveys, we are also open to feedback, both good and bad! So, if you have any comments, questions or suggestions feel free to email us at info@ipm-pensions.co.uk or call 01438 747151.