5 investment types and firms you can work with within the IPM SIPP (and 5 you can’t)

As a bespoke SIPP provider, IPM is used to being asked to hold a wide range of investments.

We have often used our blogs to highlight this variety, looking in depth at specific asset types and giving overviews as to the flexibility the IPM SIPP offers. You can re-visit some examples below:

- Everything you need to know about the many options for holding cash in the IPM SIPP

- 10 reasons we’re ideal for clients looking to hold commercial property in their pension

- 3 useful examples that compare the costs of a bespoke SIPP

Our charging structure for holding multiple investments in a SIPP is one of the most competitive in the market, as we offer a flat annual administration fee and no transaction costs or additional costs for holding more than one investment.

As a result, it is not unusual for us to see a number of different accounts or asset classes being held.

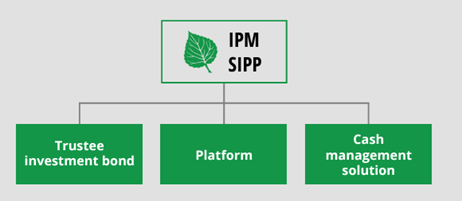

IPM’s approach is to provide clients as much flexibility as possible in terms of the investment firms they can work with and the types of assets we will allow within our Scheme.

With that said, we are mindful of the guidelines set out for SIPP operators by HMRC and must adhere to the requirements of the FCA around SIPP investments.

As a result, we have our own internal processes and assessments we follow when considering investment requests.

Here are five investment types and firms that you can work with within the IPM SIPP, and five we will say “no” to.

5 investment types and firms you can work with within the IPM SIPP

1. National Savings & Investments

National Savings & Investments (NS&I) products are perennially popular with clients given that they can offer a greater level of protection. NS&I investments are covered up to £1 million, as opposed to the maximum £85,000 compensation limit for banks under the FSCS.

It is important to note that not all NS&I products are available to SIPPs. Advisers should check with NS&I before making a recommendation for a SIPP.

2. PruFunds

Prudential’s PruFunds range has proved to be a popular choice of advisers for their clients. In November 2024, M&G reported that over £63 billion had been invested in the fund range on behalf of 450,000 clients.

There have long been discussions about having the PruFund range available through mainstream platforms. However, for whatever reason, this has not come to pass.

To invest pension monies in PruFunds this means that people either have to:

- Open a Prudential pension product, or

- Establish a Prudential Trustee Investment Plan (TIP) with a third-party provider.

We have many clients who have a Prudential TIP in our SIPP, where clients can hold the PruFunds alongside other assets such as commercial property, cash solutions, or an adviser’s preferred platform choice.

3. Gold

Gold is an allowable investment within a registered pension scheme such as a SIPP. However, there are very specific rules from HMRC around this; there aren’t SIPP providers with large amounts of gold bars sitting in their offices!

The Pension Tax Manual specifies that the “definition of investment grade gold is gold of a purity not less than 995 thousandths that is in a form of a bar or a wafer, of a weight accepted by the bullion markets”. If an investment is made on this basis, it will not be subject to tangible movable property rules.

The reality of investing in physical gold in a SIPP involves opening an account with a specialist gold bullion firm, which will execute the investment requests and hold the gold on a client’s behalf. These firms must be able to satisfy HMRC’s specifications around physical gold investment within a SIPP, as well as the requirements of the SIPP provider.

As an alternative, it may be possible to invest in an Exchange-Traded Fund (ETF) that allows investors to track the price of gold.

4. Portfolios in currencies other than GBP

With the right investment partner, IPM is comfortable to hold assets in currencies other than GBP.

This is usually most common where a client may not live in the UK but still retains UK pension benefits.

We are used to people who may reside in the US and within Europe and wish to run their SIPP in USD or EUR. This gives them the advantage that when they look to draw benefits, the IPM SIPP has the flexibility to potentially pay these in USD or EUR, eliminating the currency exchange risk.

Read more: How our SIPP can really add value if you have overseas pension clients

The SIPP will still be reported to HMRC in GBP and any monies into the SIPP would also be GBP. If any tax is due on income taken from the SIPP, this will also need to be paid in GBP.

5. Non-standard assets

IPM does not take on large volumes of non-standard assets.

That said, we will consider these on a case-by-case basis. IPM has a thorough and extensive process for assessing requests into non-standard investments that consider both the investment we are being asked to make and the circumstances of the SIPP beneficiary.

Examples of non-standard assets are a quarterly dealing hedge fund, which trades once a quarter and is not based in the UK for an individual with relevant experience in this area, or a cash account with a notice period greater than 30 days that cannot be broken.

5 investment types you can’t hold within the IPM SIPP

1. Unquoted shares

Unquoted shares are probably our most common investment request that we turn down.

While permitted under HMRC guidelines, this is not something we have ever been comfortable with as an investment within our Scheme.

We can foresee issues around the day-to-day administration for unlisted shares including valuations and selling them should there ever be a requirement to (such as in the event of the SIPP beneficiary’s death).

A further consideration for us now would be that unquoted shares would fall under the FCA’s criteria of non-standard assets, meaning there is a wide range of regulatory requirements we would need to meet before allowing such an investment.

2. Loans from the SIPP or peer-to-peer lending

Loans by a SIPP to connected parties are considered unauthorised payments and can result in tax charges.

While HMRC guidelines do allow for SIPPs to make loans to unconnected third parties, this is not something IPM will accommodate. Our reasons for this are again administrative but also, in our role as a trustee, relate to the security regarding pension scheme funds.

A question we are regularly asked is whether we will allow peer-to-peer lending (P2P).

Myriad investment vehicles are put to us for these investments to be made, but this is still something we are not comfortable with.

While we need to assess each type of vehicle put forward to us, we do not know how we can ensure that any of the monies invested would not end up in a loan to a connected party.

3. Properties outside the UK

IPM will consider any UK-based commercial property on a freehold or leasehold basis as an investment within our Scheme. However, we will not purchase properties that are not in the UK.

Again, this is down to administrative issues both during the purchase process and on an ongoing basis.

After pension simplification in 2006, property purchase outside the UK was allowable. We received an enquiry to purchase a warehouse in Portugal, so we thought we’d give it a go.

It quickly became apparent that the vendor’s representatives did not speak English, nor were familiar with UK pensions or UK trust law. We also learned that there were a variety of taxes applied on Portuguese commercial properties, which conflicted with the tax status of UK pension schemes.

As such, we cancelled the transaction and have not re-visited non-UK property transactions.

4. Properties with rent arrears

This involves us being asked to accept a transfer in-specie of a property from another SIPP or a SSAS.

On occasion, we are asked to accept transfers of properties where the tenant has built up arrears.

While dealing with arrears is something we have to deal with on properties we own within our Scheme, we do not want to start off bringing in property that has monies owed.

Not only do we not want to inherit a problem, but it is likely that we will not receive all the information required to correct the position.

We do, however, help a lot of advisers and clients with transfers in-specie of properties where arrears are not in place. You can read more about how to make a transfer in-specie of property in this case study here.

5. Low-yielding land purchases

We receive a lot of requests to purchase land within the SIPP.

While we can accommodate land purchases, we approach these more cautiously than traditional property transactions:

- We will want to ensure the land has separate access and title.

- We need to understand what the land will be used for, as any land purchase by the SIPP needs to be seen as a genuine commercial investment by HMRC.

- Any land purchase is seen by IPM, as trustees to the SIPP, as an investment of pension scheme monies. As a result, the purchase needs to make financial sense; why would the SIPP make this investment? We are often asked to make purchases of low-value pieces of land or purchase land where the rental return is low – in some instances, not covering IPM’s ongoing annual administration fee.

Get in touch

If you want to have a chat about the investment types and firms you can work with within the IPM SIPP, or any other aspects of pension planning, please contact us. Email info@ipm-pensions.co.uk or call 01438 747151.