How the recent National Insurance and Dividend Tax rises will affect your business owner and director clients

In September 2021, the government announced a new Health and Social Care Levy, designed to provide additional funding to the NHS post-Covid, and to fund social care reforms.

Ahead of the new levy coming into force in April 2023, the government announced a matching 1.25 percentage point rise in National Insurance contributions (NICs) that will be paid by employees, employers, and the self-employed from the 2022/23 tax year.

For company directors, this 1.25 percentage point increase, which incidentally also applies to Dividend Tax, will likely result in a higher tax bill for clients personally and their business.

During the spring statement, the chancellor then raised the National Insurance Primary Threshold and Lower Profits Limit, for employees and the self-employed respectively, from £9,880 to £12,570. This equalises the NICs and Income Tax threshold from July 2022.

Businesses have already been through trying times with the Covid-19 pandemic and the rising rate of inflation. So, with Corporation Tax also set to rise for larger businesses in 2023, many clients are considering ways to plan in a more tax-efficient manner.

Here’s how the upcoming tax rises will affect your business owner and company director clients.

How the rise in Dividend Tax and NICs will affect company directors

As the owner or part-owner of a company, clients need to balance out how their own salary is affected by these tax rises, while taking on enough of the burden to minimise the effect on their business.

Alongside the tax and NICs paid personally, clients’ businesses will also likely pay both Corporation Tax and National Insurance, meaning there will be challenges posed to both a client’s personal and corporate wealth.

National Insurance will rise from 6 April 2022

Both personal and corporate wealth will be affected by the 1.25 percentage point increase in NICs in the 2022/23 tax year – even taking into account the rise in the threshold at which NICs become due.

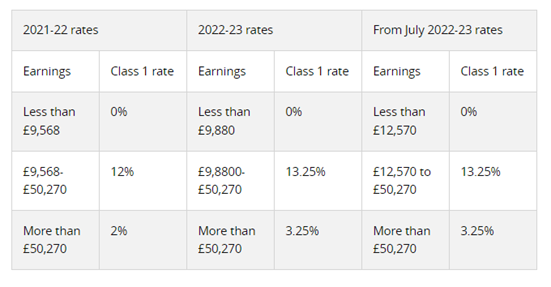

Here’s a summary of how the rates and thresholds will change over the next few months.

Source: Which?

The Guardian report that someone earning £25,000 will be £205 better off from July 2022, while someone earning £60,000 will see their take-home pay fall by £232.

Dividend Tax is rising from April 2022

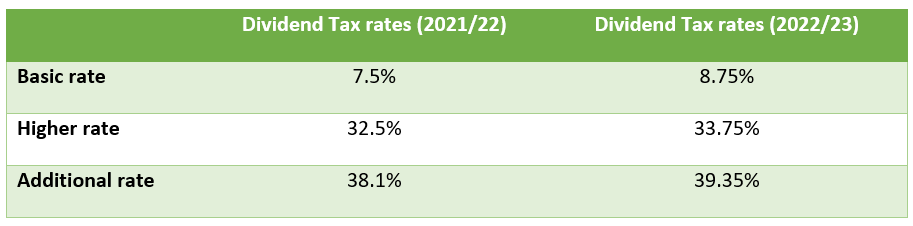

The below table compares the basic, higher, and additional rates of Dividend Tax between 2021/22 and 2022/23.

Source: FTAdviser

On the personal side of things, if a client takes home more than £2,000 a year in dividends, higher tax on these dividends will be due in the 2022/23 tax year.

For example, if a client takes £10,000 in dividends a year, £8,000 will have the new Dividend Tax rate applied. In this scenario, their Dividend Tax bill would increase by £100 to £2,700.

While these changes may seem incremental, when combined with the increased NICs and proposed changes to Corporation Tax, both company and personal wealth could be more significantly affected than first thought.

Clients can use pension contributions to reduce Dividend Tax and NICs

As you will be aware, pension contributions attract tax relief.

As a business owner or director, assuming employer pension contributions are “wholly and exclusively for the purposes of the business”, clients’ companies can receive Corporation Tax and National Insurance relief.

In 2021/22, that is a 13.8% National Insurance saving, which a client could redirect to their pension pot. This will rise to 15.05% from 2022/23 when employer National Insurance rates rise.

While taking dividends may still be more tax-efficient than drawing a salary, the 1.25% Dividend Tax increase might mean that exchanging some dividend payments for pension contributions could be a better option.

Read our useful blog for a further look at paying pension contributions and how these may offset any impact of these tax rises.

Get in touch

If you want to have a chat about the potential of SIPPs for your clients, or any other aspects of pension planning, please contact us. Email info@ipm-pensions.co.uk or call 01438 747 151.