SIPP v SSAS: Which pension is most appropriate for your client?

Last week, I spoke with three financial advisers who were looking at pension planning for groups of clients. All three advisers made comments such as “We are also looking at a SSAS” and “What do you think would be better: a SIPP or SSAS?”

Early disclosure – IPM only offers a SIPP. While you may think this would lead us to having a biased answer in the SIPP v SSAS argument, we do try and talk through each scenario with our advisers to see which route would deliver the best outcome for their clients, even if this is ultimately a SSAS!

For many people not involved in financial services, they may well be more familiar with the term SIPP than SSAS. I am sure you have seen or heard adverts that reference SIPPs by some of the bigger plays in the market.

The SIPP market has evolved significantly over the years, benefiting from technological developments. We have previously looked at the three main types of SIPPs available for advisers to recommend to their clients, and a recent report suggested that there are over 60 different SIPP providers in the market with assets held valued at more than £300 billion.

However, SSASs still remain popular. In 2023, HMRC received almost 2,000 applications to set up registered pension schemes.

Same, but different?

Although SIPPs and SSASs are two separate products, there are actually a lot of commonalities between both types of offerings.

Both are registered pension schemes in the eyes of HMRC. This means that, broadly speaking, the rules around taxation, distribution of benefits, investments, and borrowing are the same. For example, there is no legislative reason why holding a commercial property in a SSAS is more beneficial than a SIPP, and vice versa.

The differences lie in how certain aspects of legislation are applied to each type of scheme and how they operate day to day. It is these latter two points we believe will drive the decision as to whether a SIPP or SSAS is the best option for your clients.

Let’s look more closely at SSASs…

A small self-administered scheme (SSAS) is an occupational pension scheme that, historically, has been established for senior staff members of limited companies looking for greater investment flexibility.

This flexibility might include purchasing commercial property as well as making loans to, and having shares in, the sponsoring employer – the latter two options being something most SIPP providers will typically not offer.

Rather than joining a large, already established scheme, a SSAS is individually registered with HMRC. The timescales for this registration to take place can vary, and could take a few months.

So, if you have a client who needs to move quickly – perhaps to instruct solicitors on a property purchase – then they would need to consider this.

As the name suggests, a SSAS tends to have a smaller number of members and, usually, each member of the SSAS acts as a trustee to the scheme.

This can allow a greater degree of flexibility compared to most SIPPs, as the clients have a say in how the scheme is run.

However, HMRC will view scheme trustees as scheme administrators. This can place more onus on individuals as they are responsible for the day-to-day running of the SSAS, which can include:

- Making investments

- Carrying out the required returns to HMRC

- Dealing with contribution tax relief

- Being responsible for providing scheme members with specific information including lump sum allowances, dealing with death benefit distributions, and any transfers.

A professional trustee will usually sit alongside the member trustees.

For larger numbers of clients, a SSAS could prove to be a cost-effective option. Most professional trustees will charge an annual fee for assisting with the scheme, followed by a lower cost for each member.

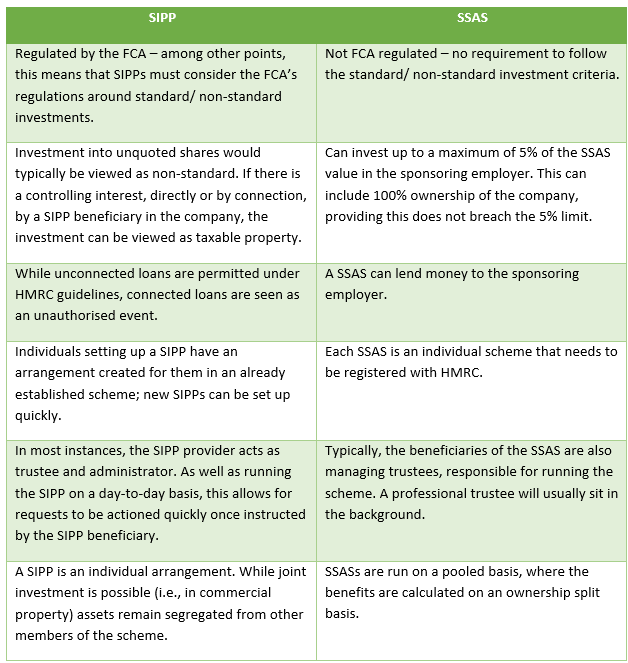

There are two key points that differentiate SSASs and SIPPs:

- In a SSAS, assets are typically not allocated to each individual client. Instead, each client has a percentage beneficial ownership of the scheme.

- SSASs are not regulated by the FCA. This means there is no distinction between standard and non-standard assets, as is the case with SIPPs.

Let’s look more closely at SIPPs…

A self-invested personal pension (SIPP) is a personal pension that can be set up with an insurance company or specialist SIPP operator. Anyone can take out a SIPP, so long as they meet their chosen provider’s eligibility requirements. These can vary when it comes to criteria such as minimum fund requirements.

By establishing a SIPP, an individual is joining an already established scheme. Their arrangements (and assets) are ringfenced from other members of the scheme so that these are easily identifiable and attributable to that individual.

Most SIPPs are “master trust” arrangements. This means that the SIPP provider is the sole trustee and is the only party that is an authorised signatory to the SIPP.

However, it is often the case that the provider will allow individuals and their advisers to give investment instructions directly on the SIPP’s behalf. Some SIPPs are on a co-trustee basis, meaning that these work on a similar basis to a SSAS where the client is also a trustee.

Unlike a SSAS, the SIPP provider will typically be responsible for the day-to-day administration of the SIPP. For example, a SIPP provider will submit one tax relief reclaim to HMRC for all clients who have made personal contributions to a SIPP on a monthly basis.

As briefly touched upon earlier, the evolution of the SIPP market now means there are various offerings available. These have varying levels of flexibility in terms of service, charges, investments available, and the way clients can draw benefits. It is important to ensure that the SIPP selected for an individual will meet their requirements.

IPM has previously considered the various types of SIPP offerings available and narrowed these down to three different types.

SIPP vs SSAS – side by side

So… SIPP or SSAS?

Ultimately, the decision as to which type of arrangement to pick will depend on the client and their circumstances.

Historically, SSASs have been left behind as the SIPP industry has grown – although the SSAS has made a comeback over recent years.

When advisers ask us the SSAS or SIPP question, the first thing we ask them is: “Why would you consider a SSAS over a SIPP?”

A SSAS could be the right avenue if their answer is that their clients want to:

- Buy shares in their company

- Make a loan to their company from the pension scheme.

Cost can also be a factor.

Typically, SSAS administrators will charge a fee to run the scheme in addition to a small “per member” fee. So, if you have six directors using a pension scheme to purchase the company’s business premises, this can be more cost-effective than running six individual SIPPs.

However, the trade-off can be that each of these clients will be trustees, putting individual responsibilities on each of them. The ongoing administration of the SSAS, plus the need for all clients to sign scheme documentation in some instances, means that members end up committing additional time and effort to the management of the scheme.

Furthermore, trustee decisions must be unanimous so may not suit different levels of investment risk profiles between scheme members. For example, someone approaching retirement may have a different need or tolerance for risk compared with someone still building their pension savings.

Most clients who consider a SIPP or a SSAS are high net worth individuals busy running their own companies. Do they really want to run a pension scheme too?

We see SIPPs as a preferable option in many cases

It may not surprise you to learn that, in most cases, we believe SIPPs are a more appropriate choice for clients!

One of the reasons for this is that SIPPs are individual arrangements. So, while a group of SIPP clients may come together to make a joint investment (for example, a property) any other action they take regarding their pension (transfers in, contributions, other investments, taking benefits, and so on) usually does not impact the other members of their group. Clients may not want their colleagues to know everything about their pension!

Buying property can be testing enough. Buying a property through a pension can add an extra (but not unmanageable) layer of complexity. Within a SSAS, you then need to consider that each trustee (client) may need to sign all documentation relating to that purchase.

With a SIPP such as ours, IPM can sign all documentation in-house on the same day.

It’s true that the cost of running several individual SIPPs can be more expensive than running one SSAS. Of course, this depends on which SIPP provider your clients work with – note that we’re one of the most cost-effective SIPP providers in the market for SIPP property purchase.

However, clients may be happy to pay some additional fees so that they:

- Are not trustees of the pension

- Can keep their pension benefits separate from their colleagues, especially when someone leaves the company. Under a SSAS, they could still be a trustee.

A client can establish a SIPP immediately, whereas the time to establish a SSAS can vary; this can be particularly crucial in situations like paying contributions around the end of the tax year or the company year-end.

Despite all this, a SSAS can still be a useful tool in an adviser’s armoury when dealing with high net worth and bespoke pension situations. There are some great SSAS providers in the market, and typically, you will find technically astute individuals in these businesses.

Should the need arise, a SIPP to SSAS transfer is possible so that the client benefits from the additional flexibility they require in terms of running the scheme, the investments it can make, or mitigating costs.

Get in touch

If you want to have a chat about the potential of SIPPs for your clients, or any other aspects of pension planning, please contact us. Email info@ipm-pensions.co.uk or call 01438 747151.