The state of the SIPP market in 2024 – here’s what you told us

In the spring of 2024, FTAdviser ran the headline: “SIPP market projected to grow to £750 billion by 2030”.

Considering the current market is worth around £500 billion, that is quite the increase in just half a decade. The two key factors likely to drive this expansion, according to the report, are:

- The impact of the pensions dashboard

- The adoption of a “pot for life” model.

Much of this growth will likely be achieved in the “streamlined” SIPP sector, by investment platforms and other new fintech entrants to the market. Indeed, the report highlights that two-thirds of all SIPPs operate on a non-advised basis.

While the ease of use of investing apps and an individual’s ability to consolidate their pension savings easily in one place might increase SIPP assets under management, there will still be a place for “complex” SIPP products, and advice in this area.

In our recent adviser survey, we asked you for your comments about the state of the SIPP market in 2024. Here’s what you told us.

82% of advisers/planners recommending as many or more bespoke SIPPs than 3 years ago

We wanted to understand whether the demand for bespoke SIPPs was still strong and whether advisers and planners were still recommending bespoke SIPPs to clients.

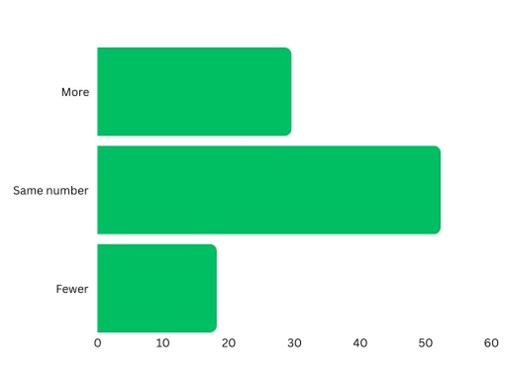

We asked you whether, over the last three years, you had recommended more bespoke SIPPs to clients, the same number, or fewer.

Overall, 82% of advisers and planners are recommending the same number or more bespoke SIPPs than before. This demonstrates that there remains a strong demand for the sort of bespoke SIPP that IPM offers.

Those of you who are recommending fewer bespoke SIPPs cited several reasons:

- “Where ‘investment only’ we are using more investment platforms where values are less than £350,000”

- “It is a niche area and we are a small business, so cases that are right for a bespoke SIPP are limited”

- “Less involvement in property purchase via pensions”.

As one of you told us: “Compliance makes it very difficult to go off-piste, and downward pressure on platform charges has made it harder to justify a SIPP over a platform for standard business.”

We are very open with our advisers that we would happily work with them for any SIPP client who they feel would benefit from IPM’s services. However, we appreciate that for a lot of clients a simple, online SIPP may well suit their requirements.

With that said, our own experience with advisers as well as the feedback in the survey still shows to us that there is very much still a place in the market for a bespoke SIPP for the right client and the right circumstances. Our recent article shows where a bespoke SIPP can fit into the suite of solutions advisers can offer their clients.

Those of you who continue to recommend bespoke SIPPs cited various reasons:

- Moving from SSAS to SIPP

- Continued requirement for holding property

- To invest in DFMs

- New clients continue to have specific and complex requirements

- Service and quality issues from some of the mainstream providers.

As we have always said, the nature of a bespoke SIPP is that it can be an ideal solution for a client with more complex requirements. And, as one of you told us: “Complexity shows no sign of abating”.

Someone who might want to save £100 a month into a pension may be better serviced by an online or limited SIPP with a more restricted number of investment options, as opposed to a bespoke SIPP offered by a firm like IPM.

However, we can help where clients:

- Are seeking to hold or purchase a commercial property through a SIPP

- Want to benefit from a simplified, transparent fee structure

- Want to hold investments with more than one investment house

- Want to break up or simplify a SSAS arrangement

- Live outside the UK

- Are looking for a more bespoke, specialist service.

It has been well-documented in recent years that some high-profile SIPP providers have failed, increasing consolidation in the sector. The issues within the market were certainly of concern to some advisers/planners – comments concerning this included:

- “It is very tricky to rely on a SIPP provider with the regular bad news in the industry”

- “It’s important to feel confident that bespoke SIPP providers aren’t caught up in unregulated investments that could be a risk to their continued business”.

Indeed, FTAdviser reports the view that there may be just 20 complex SIPP providers in five years.

These are likely to be strong, well-run specialist firms – as one of you commented: “There is a very small number of good firms. The larger ones aren’t able to deal with a personalised service and place too many restrictions on clients.”

As a privately-owned business, we’re strong and solvent – if you want to find out more, here are five valuable reasons you can recommend IPM to your clients with confidence.

As an extra step in giving advisers confidence in IPM, AKG have also recently awarded us a rating of “B- Satisfactory”, which included a five-star review for our service. You can read more about this in our recent article.

Get in touch

If you want to have a chat about the potential of SIPPs for your clients, or any other aspects of pension planning, please contact us.

Email info@ipm-pensions.co.uk or call 01438 747151.